But this compensation does not influence the data we publish, or even the assessments that you see on This website. We do not contain the universe of companies or economic presents That could be available to you.

All of our content is authored by really skilled experts and edited by material gurus, who ensure every thing we publish is objective, exact and honest. Our loans reporters and editors give attention to the details customers care about most — the different types of lending possibilities, the most beneficial prices, the top lenders, the best way to repay personal debt and even more — so that you can truly feel confident when investing your cash.

Credit unions consider a personal loan applicant’s heritage as being a member when building a decision, meaning a good connection With all the credit union could help with acceptance.

you can find differing kinds of no-credit-Check out loans, and many include predatory conditions which include large APRs and small repayment conditions.

as an example, if you have enough time and the opportunity to do this, take into account enhancing your credit score before implementing for any loan. you can begin To accomplish this by lowering your credit utilization ratio and earning common, promptly payments towards your credit playing cards and other loans.

the largest downside to selecting an internet based lender is you gained’t have the option to meet your lender in human being or check out a close-by site if any inquiries or troubles arise. For the most beneficial bad credit loans of both equally worlds, select a trustworthy lender that operates both equally on the web and in-individual.

A health-related bank loan is usually a style of personal mortgage. While you might get accepted for a loan although possessing a lousy credit score, you could realize that it comes along with a better annual percentage charge (APR) and may not be accredited with the loan amount you were being hoping for.

Predatory lenders make use of customers with low credit scores who want cash by charging large interest costs for no-credit-Verify loans.

. By submitting your info, you conform to get email messages from motor by MoneyLion. Select will not Command and is not answerable for third party procedures or procedures, nor does pick have access to any details you supply.

greatest credit cardsBest reward offer you credit cardsBest balance transfer credit cardsBest vacation credit cardsBest funds again credit cardsBest 0% APR credit cardsBest rewards credit cardsBest airline credit cardsBest university college student credit cardsBest credit cards for groceries

considering the fact that there is not any collateral, economical institutions give out unsecured loans primarily based largely on your credit score, earnings and historical past of repaying previous debts. Because of this, unsecured loans could have increased fascination rates (but not normally) than the usual secured loan.

Secured, co-signed and joint loans are the best to acquire with negative credit. A secured mortgage needs collateral just like a motor vehicle or cost savings account, which the lender might take for those who are unsuccessful to repay.

Out-of-the-blue calls or textual content presents for loans. If you receive a cellphone call or textual content which has a personal financial loan supply from the company with whom you’ve experienced no preceding Get in touch with, treat with Serious suspicion.

You can (at times) get yourself a reduced amount with a co-signer. Some lenders specializing in borrowers with poor credit will Permit you take over a co-signer to increase your qualification chances. A co-signer may additionally assist you to improve curiosity rates.

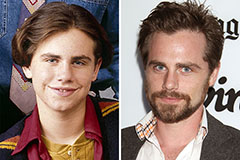

Rider Strong Then & Now!

Rider Strong Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!